|

|

|

Published since 1990, Sound Mind Investing is America's best-selling financial newsletter written from a biblical perspective. Visit the Sound Mind Investing Web site.

Request a free information packet regarding the Sound Mind Investing newsletter.

Investigate the widely-acclaimed Sound Mind Investing book, available at a 35 percent discount!

|

| |

|

Smart Investing

Should I Invest in Load Funds?

CBN.com

– A no-load fund is a mutual fund that is sold without a sales markup. This is usually done by the mutual fund organization foregoing the use of a sales force and selling directly to investors.

Obviously, all other things being equal, investors would prefer not to pay a sales markup. But are there advantages to load funds that make the sales charge a reasonable cost for investors to incur?

Before tackling that question, let's have a quick review of load funds for the benefit of newcomers. A load fund is a mutual fund that is sold to investors through a sales network, typically by stock brokers, financial planners, and insurance agents. For this service, the investor pays a markup or sales charge. The sales charge, called the "load," is usually paid at the time the fund shares are purchased.

Some funds, however, use back-end loads (also called deferred sales charges). Typically, if you sell during the first year, you are charged a back-end commission ranging from 4% to 6% of the amount originally invested. The percentage drops each year, gradually declining to zero after five or so years. Deferred loads are deducted from your proceeds when you pull your money out.

For years, load fund proponents argued that their performance was superior to that of no-load funds. However, studies have long since shown that the performance differences are not significant and this boast is no longer credible.

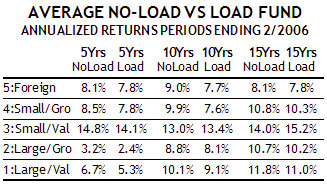

For this article, I did a quick analysis using the Morningstar mutual fund database. Look at the performance numbers in the table to the left for the two types of U.S. diversified stock funds. For this article, I did a quick analysis using the Morningstar mutual fund database. Look at the performance numbers in the table to the left for the two types of U.S. diversified stock funds.

These are the net annualized returns after allowing for all fund operating expenses, but not adjusting for the cost of the loads. As you can see, even before the sales charges ranging from 3% to 5% for the load funds are deducted, the no-load groups have narrow performance advantages across four of the five risk categories. What was a slight performance edge in favor of the no-loads turns into a significant advantage once you reduce the load results to account for the sales markup.

Having lost the performance argument, the load funds came up with a new slant: their performance numbers may not be better, but the return experienced by investors in load funds will nevertheless be higher. They base this claim on a study that purports to show that no-load investors do worse than load investors because they trade their funds too often. This leads to counterproductive results. Load investors, on the other hand, tend to "stay put"—either because they're inhibited by the sales load or because the broker who sold the fund tempers their impulsiveness.

Critics claim the study is flawed because it incorrectly assumes that when a no-load investor sells a fund, the money is pulled out of the market rather than being reinvested in another stock fund. We side with the critics on that score, but will agree that to the extent the load discourages short-term trading, it provides a benefit.

For many years, the load fund industry argued that, over time, no-load stock funds would prove more expensive to own due to the fact that their annual operating expenses would be higher. If this was ever the case, it certainly has not been true for the past 15 years. Indeed, even disregarding the sales markup, the opposite is true—load stock funds, on average, are more expensive to own. Currently, they have an average annual expense of about 1.9% versus the no-load average of 1.5%.

Now we come to the strongest point in favor of load funds—personalized, professional counsel. Load fund proponents would do well to turn the investor's mindset away from "What's it going to cost me?" toward "Do I know what I'm doing?" Many investors feel the need for personalized financial advice rather than the limited service usually offered by no-load fund organizations.

The kind of advice we're talking about involves evaluating a fund's investment merit and suitability, and putting together a combination of funds that balance risk with your need for growth and current income. It means recommending an appropriate degree of diversification, and taking any special tax considerations into account. Depending on the skills of the person you're dealing with, it may also involve insurance and estate planning.

If you need this kind of help, then paying the load may well be worth it. However, be sure to check references to verify that the advice you receive is competent (what training and experience does your broker/planner have?), objective (do they represent more than one fund organization so they can provide you with a healthy number of fund options?), and on-going (how often will they be there after the sale to help you monitor the results and make mid-course corrections to your plan as needed?).

In our Sound Mind Investing newsletter, we try to regularly emphasize why we are here serving you in this way: We want to help you to have more so you can give more to share the good news of Christ's love with the world.

CBN IS HERE FOR YOU!

Are you seeking answers in life? Are you hurting?

Are you facing a difficult situation?

A caring friend will be there to pray with you in your time of need.

|